Managing a business can be a difficult and precarious undertaking, which places continuous pressure on company leaders to improve performance, reduce expenses, streamline processes, and maximize profits. As technology advances, an ever-growing number of businesses are turning to financial software development to improve their accounting procedures and increase efficiency.

This article will comprehensively examine accounting software development, covering its main advantages, accounting software features, the various kinds of accounting software, steps for choosing a software development company, and other related topics.

Table of Contents

- Why invest in Accounting Software Development?

- How does the Accounting Software Work?

- Types of Accounting Software

- Challenges and Breakthroughs of Accounting Software

- Accounting Software Features

- How to approach Accounting Software Development?

- Steps of the Software Development Life Cycle to make your Accounting Software

- Cost to Develop Accounting Software

Why invest in Accounting Software Development?

Accounting is a critical component of running a business and cannot be neglected. Web-based accounting software helps in keeping track of both incoming and outgoing finances, and the information produced by the accounting department facilitates the assessment of the company’s progress.

A broad selection of solutions can be achieved through tailored accounting software that caters to both small businesses and large corporations. But what precise challenges can account software tackle? Here are they:

- Speed up data processing: Rapid and efficient data processing is essential in the current dynamic business landscape. Financial accounting software is useful in this regard, as it enables users to swiftly access crucial data.

- Reduce the frequency of human errors: By delivering reliable calculations and operations consistently, accounting software provides organizations with peace of mind regarding the accuracy of their financial records once they’ve implemented an accounting system.

- Reduces time consumption and enhances efficiency: Finance and accounting software is beneficial in terms of saving both time and money. By automating several financial processes, the software enables smooth functioning without the constant supervision of accountants.

The primary reason for developing accounting software is the requirement to store massive amounts of data. By swiftly recording all alterations, the software grants accountants access to vital information and minimizes the possibility of human error by processing data at a faster pace.

How does the Accounting Software Work?

Whether your company adapts a traditional finance business model or a SaaS business model, you require accurate accounting software functioning because it works as a tool for overseeing different financial aspects, including sales, profits, cash flow, reserves, credit allocation, and financial statements.

Accounting software, like financial management software, is created to furnish individuals and organizations with a mechanism to monitor significant financial information, usually involving data on money flow, assets, stock, and related financial details.

Although there are diverse calculation methods, most accounting software programs include a database of these assets, providing significant advantages for financial management professionals. Businesses of all sizes can obtain customized accounting software that guarantees secure operations and considerable improvements to their accounting procedures.

By integrating all aspects of cash flow management, customized accounting software can simplify cash management and enhance overall efficiency; nevertheless, it is always better to ask for a ‘Request for Proposal’ that defines your business objectives and inputs from your tech partners to have things clear before proceeding for software development.

Types of Accounting Software

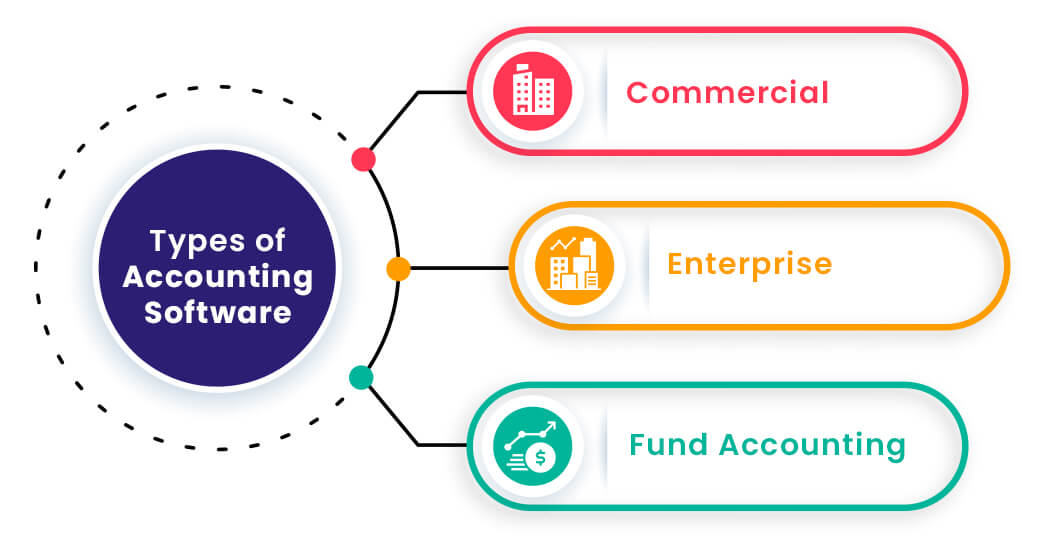

Firstly, it is crucial to consider the various types of accounting software that are currently available in the market. All accounting software is intended to manage business finances, ensure precise record-keeping, and simplify recurring tasks like invoicing and reconciliation. However, differences can be identified in terms of their level of complexity and functionality.

The size of your organization and the need for scalability usually dictate the kind of accounting software that is needed. Therefore, let’s delve deeper into the three primary types of accounting software solutions that you may come across.

Commercial Accounting Software

Mid-sized companies frequently utilize commercial solutions as their accountants seek a more streamlined approach to managing financial reports, accessing data, monitoring cash flow, and handling other financial tasks.

Typically, these solutions made by fintech software development firms are equipped with features that are appropriate for the majority of companies and therefore necessitate minimal customization. Nonetheless, they can be customized and integrated with other systems to meet the specific requirements of each individual company.

Enterprise Accounting Software

Large corporations and businesses aiming to expand their operations often opt for enterprise accounting software. These are usually customized solutions that can handle vast amounts of data and are a component of corporate ERP systems. According to stats, the ERP software market is predicted to touch 100.7 US billion dollars by the end of 2025.

Similar to commercial software, this software category is capable of integrating with other programs that the organization employs for business intelligence, project planning, and workflow management. Typically, this necessity is attended to in the initial phases of the software development process to guarantee that the upcoming solution is created with all the fundamental elements in consideration from the outset.

Fund Accounting Software

The main purpose of fund accounting software is to assist nonprofit or fundraising organizations in managing their fundraising coordination, donation management, and financial reporting tasks. It is focused primarily on accountability rather than profitability.

Usually, it consists of a group of self-adjusting accounts that are classified as unrestricted, temporarily restricted, or fully restricted, based on the constraints set by the provider.

Challenges and Breakthroughs of Accounting Software

The accounting software system has contributed to significant advancements in the field of accounting. Such software has made it possible for businesses to automate various accounting tasks, including bookkeeping, invoicing, and financial reporting, thereby reducing the likelihood of errors and saving time.

However, it is important to consider the notable challenges associated with accounting software:

One of the major challenges of accounting software is ensuring the security of financial data. Since such software is accessed through the internet or mobile devices, they are vulnerable to security breaches and cyber-attacks. Thus, software developers need to implement robust security measures to safeguard sensitive financial information.

Another challenge is the need to integrate accounting software with other business software and systems. This can be a complex task, as different software may use different data formats and structures, making data integration difficult.

Accounting Software Features

Most financial software Development Company is designed to handle bookkeeping tasks and simplify related procedures. It is crucial to recognize that not all solutions are the same. Consequently, we aim to emphasize some crucial characteristics that you must contemplate while developing your tool.

Payroll Management

Payroll processing is a crucial aspect of accounting software, as it is required by all businesses with employees who need to be paid. To commence the process, the system is fed with pertinent information about each employee, including their working hours and compensation.

From that point onward, the software takes control, streamlining salary computations, deductions, and tax submissions, liberating your accountants from the dreary tasks involved in the process.

Invoice Processing

The processing of invoices is a task that accountants commonly handle. Nonetheless, building an accounting software solution dedicated to this task can significantly reduce the workload of specialists, which in turn would save a huge chunk of time. Custom-made accounting software is a useful software application, efficiently completes tasks like automating accounts receivable, invoicing, and accounts payable workflows, and assisting with general ledger maintenance.

Tax Calculation

Using accounting software can minimize human errors, particularly in the critical area of taxes where mistakes can have severe consequences. It is crucial to include the ability to calculate taxes in any complete software solution that ultimately results in time-saving.

Expense Tracking

To ensure the success of a business, it is essential to have effective management of expenses. Hence, it is important to have accounting software equipped with features that enable monitoring of employee expenses, recurring payments, and other expenditures that may accumulate over time.

Additionally, having web-based accounting software that is accessible on mobile devices will allow employees to input expenses while on the move, further enhancing cost optimization of your business organization.

Online Payment Processing

In the current era, digital payments are gaining widespread popularity, due to the pandemic that came last year, online activities thrive excessively. Including an online payment processing feature in businesses, a POS software is the highly recommended solution. This will enable the process of electronic payments and provide customers with the option to pay from their bank accounts conveniently.

Financial Reporting

The ability of accounting software to generate reports can alleviate the tiresome and time-consuming tasks performed by accountants on a monthly, quarterly, and yearly basis. The automation of report creation through software can be highly advantageous for medium and large-sized businesses as it facilitates the rapid generation of necessary documents and enables faster editing.

Credit Monitoring

To ensure accuracy, it is crucial to exercise caution when monitoring your credit. The process requires careful attention to detail as human errors may arise when performing this task manually. Employing accounting software with the feature of credit monitoring can be extremely beneficial since it decreases the likelihood of human-caused errors and proficiently handles all information related to credit.

Bank Account Linking

With the assistance of accounting software, users can seamlessly connect their bank accounts with their businesses and transfer funds without any delay. This accounting software can be customized to meet specific business needs such as employee salary payment, and bill payments.

Integration with other Platforms

To manage their operations, medium and large-sized enterprises rely on diverse platforms, including CRM or e-commerce platforms. Accounting software systems can be integrated with various systems such as electronic filing, banking services, invoicing, and billing systems. Integrating accounting software with other systems or platforms can result in a streamlined workflow, leading to time-saving and seamless task execution.

How to approach Accounting Software Development?

With a common understanding of what accounting software encompasses, it’s time to explore the process of obtaining the ideal solution that meets business requirements. In reality, there are two alternatives to consider, and each has its own advantages.

Purchase a Ready-Made Solution

Acquiring an off-the-shelf solution is one method of obtaining accounting software for your business. Typically, these solutions are crafted to fulfill the requirements of diverse users and comprise the fundamental features that most individuals look for in accounting software.

There are several advantages to customizing pre-built accounting software to suit the specific needs of individual businesses or integrating it with other software. These include low initial costs, quick implementation, and access to updates.

Develop Custom Accounting Software

Another viable choice is to develop a custom accounting software solution for enterprises. To achieve this, business owners can collaborate with in-house developers or outsource to a competent software development company to develop tailored accounting software from scratch. This method provides several advantages, such as software customized to suit your specific business needs, long-term cost savings, scalability prospects, and exclusive ownership.

Steps of the Software Development Life Cycle to make your Accounting Software

The following are the typical steps involved in the development of accounting software. You may refer to a complete guide on the software development life cycle, but there we present all steps in brief:

Understanding the Business needs of Software

In the initial phase, the software development companies takes use of their expert team for requirement analysis that includes identifying the software’s purpose, desired features, and intended audience.

Choosing Software Design & Planning

After gathering the requirements, the team creates a software design and plan. This includes creating a software architecture, designing the user interface, and creating a development plan.

Software Development

At this development step of software, the actual coding of the software takes place. The development team uses the design and tech stack to develop the software.

Software Testing

Once the software is developed, the software testing phase is started where it undergoes various testing procedures to ensure that it functions correctly and meets the specified requirements. Software testing companies perform this task by assuring unit testing, integration testing, and system testing.

Support & Maintenance for Software

In the last step of SDLC process, involves providing ongoing maintenance and support to ensure that the accounting software continues to function correctly and meets the client’s changing needs. This includes bug fixes, updates, and customer support.

Cost to Develop Accounting Software

The software development cost can differ significantly, with small-budget projects starting from $20,000 and larger businesses potentially spending over $100,000. This variation is due to the unique accounting software features and different factors, which demand a considerable amount of work.

It is worth noting that the accounting software development cost could be markedly reduced when you opt for software development outsourcing to hubs like India where currency rates are much more beneficial to the first world countries.

Top Countries to Outsource Your Accounting Software Development Project

Conclusion

The need for accounting software development to improve efficiency and mitigate risks is becoming increasingly evident among businesses of all sizes and industries. Nonetheless, not all software programs are the same, and it is crucial to determine which features are most valuable for your business.

Engaging the dedicated software development team can help companies in fulfilling their business objectives. Accounting software has transformed the way businesses handle their finances, enhancing efficiency and accuracy, and making financial management more accessible than ever before.

FAQs of Accounting Software:

How is accounting software developed?

The development of accounting software relies on key elements such as budget, business requirements, technology selection, and more. The process can be divided into four main stages, which are: identifying a suitable developer, selecting a template, constructing the MVP or functionality, and finally, overseeing support and maintenance.

How much does it cost to develop accounting software?

The ultimate price of financial custom software development is determined by various factors including the software developers’ fees and the technology and features selected. Basic accounting software development pricing can begin in the range of $10,000 to $25,000 for the lower end, $25,000 to $50,000 for the medium range, and an average of $50,000 to $100,000 for the higher end.

What are the benefits of accounting software?

Accounting software is a flexible instrument that offers multiple advantages to enhance the efficiency of your business operations. It can be used to manage basic responsibilities such as invoicing, billing, and tax calculations. In addition to that, it also offers advanced capabilities like project management, which helm essential financial reports that are crucial for the sustained growth of your business operations.

Avantika Shergil

| Apr 20, 2023

Avantika Shergil

| Apr 20, 2023

An enthusiastic Operations Manager at TopDevelopers.co, coordinating and managing the technical and functional areas. She is an adventure lover, passionate traveler, an admirer of nature, who believes that a cup of coffee is the prime source to feel rejuvenated. Researching and writing about technology keeps her boosted and enhances her professional journeying.